Not known Incorrect Statements About Invoice Factoring

Table of ContentsExcitement About Invoice FactoringThe Ultimate Guide To Invoice FactoringA Biased View of Invoice Factoring

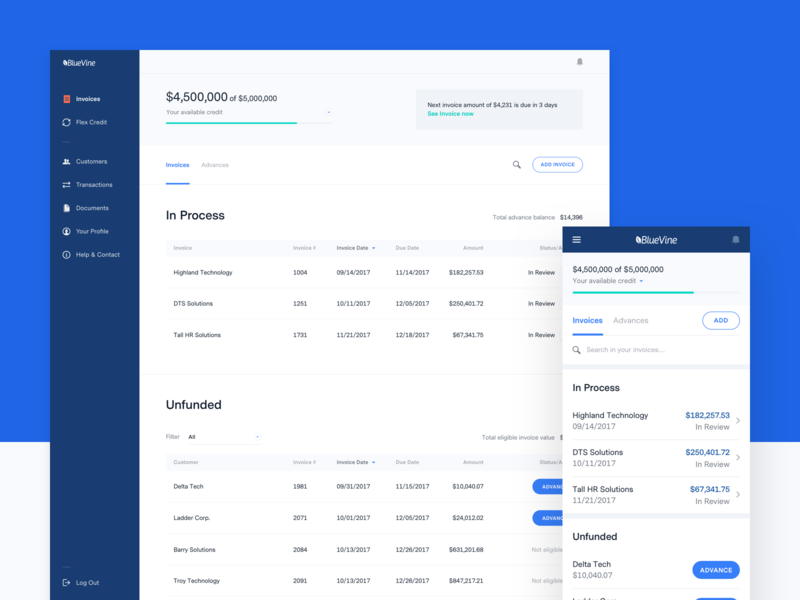

The first instalment the factoring advance covers regarding 80% of the receivable (this quantity differs). The staying 20%, less the factoring charge, is rebated as quickly as your client pays the invoice completely. Below are the actions: You send the billings for purchasingThe factoring firm sends you the advance (e.g., 80% of the invoice) Your customer pays 30 to 120 days laterThe factoring business sends you the refund (e.g., 20%, much less the charge) Summary Whilst the certain ratio can vary, it's generally done in 2 phases.Invoice finance is the typical terminology for the entire accounts- receivable financing industry. Factoring as well as discounting are for that reason sorts of asset-based financing, covered by the umbrella term 'billing financing' and they both share typical concepts. The key distinction between invoice factoring as well as discounting is that while invoice discounting permits the company to retain control of its sales ledger as well as billing collection, factoring gives the invoice finance supplier that duty.

Some companies may be worried regarding the variable taking control of the credit scores control for their company ledger, because of the partnerships with their clients and also clients. Some factoring firms will certainly have very little call with your borrowers as well as can in some circumstances, supply a solution to establish a separate bank account which they assume control of, as well as that is under your service name.

The Facts About Invoice Factoring Revealed

Recourse factoring is standard technique, unless or else specified, suggesting if your customer doesn't pay it becomes your duty to cover the price. Non-recourse factoring is a certain item in it's very own right as well as is frequently described by lending institutions as 'uncollectable loan protection'. Negative financial obligation defense protects your company from non-payment.

The billing money industry is not presently managed by the Financial Conduct Authority (FCA). With this in mind you require to exercise due diligence with any type of service provider you may pick, exploring the opportunity of concealed charges which might not be right away apparent. It's worth mentioning that guideline, must it occur in the future, would certainly likely raise the costs of factoring (invoice factoring).

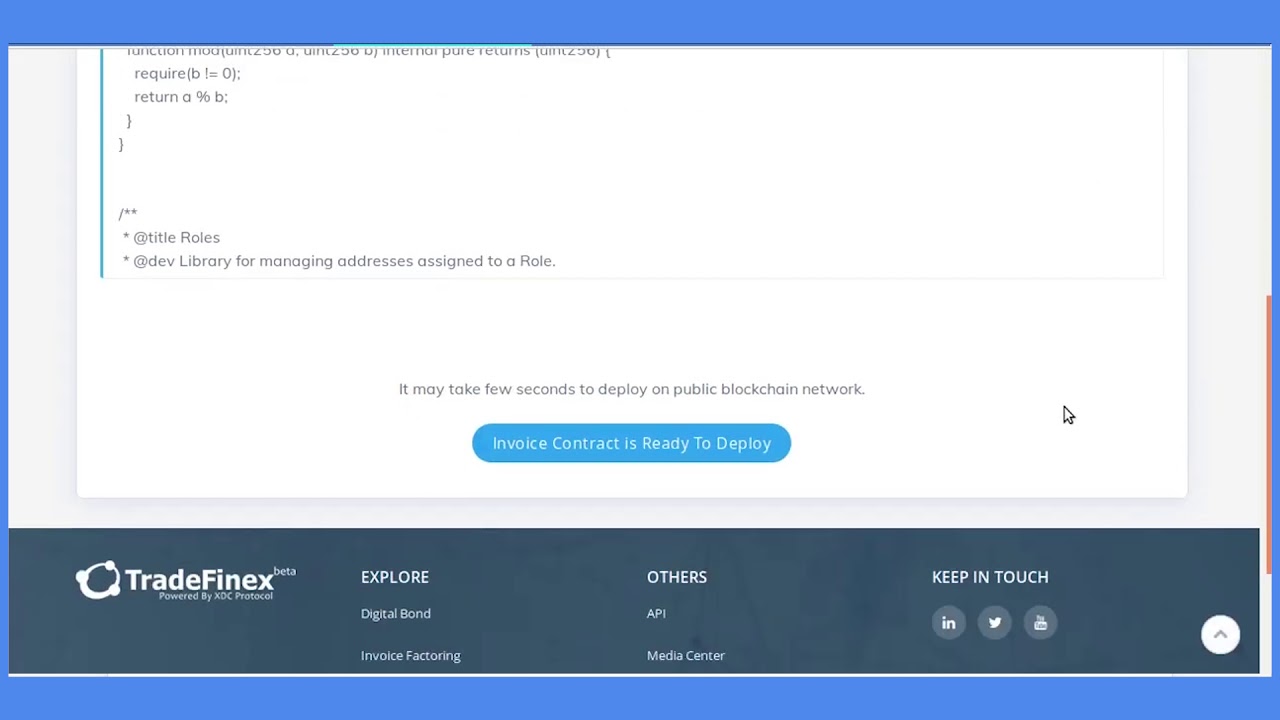

We have a number of choices to make an application for factoring solutions, whether you are aiming to factor your service' invoices uniquely, or you require a factoring center to gain access to funds, recurring. If you think your business might profit from an invoice funding please really feel totally free to either use our totally free invoice money system (below) that gives you accessibility to the entire market, load out the quick quote form in the direction of the top of this page, or just send us an e-mail.

Fascination About Invoice Factoring

Learn more details about just how factoring jobs on the Business Professional web site. A lot of the well understood financial institutions do use factoring although some are extremely cautious regarding taking on customers outside of their existing service customers. Use Company Specialist's free quote service to get quotes from a variety of the leading lenders.

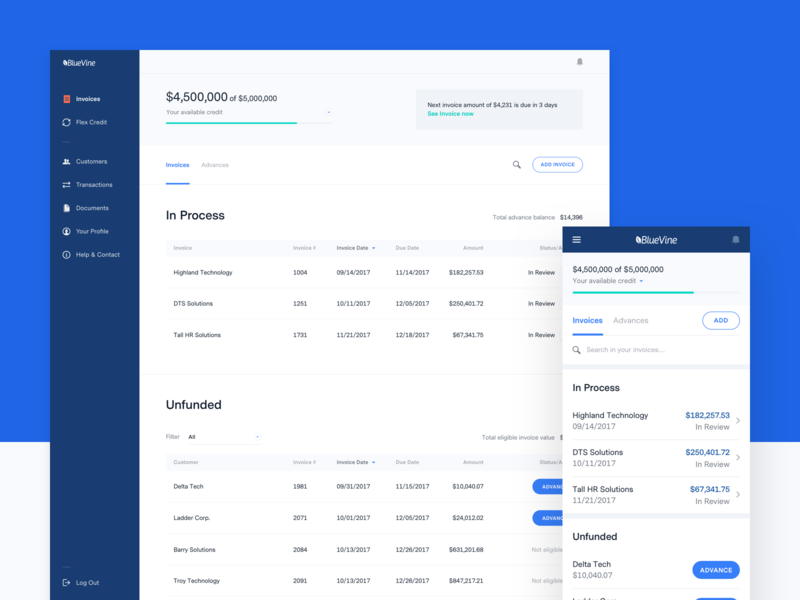

Billing factoring is a way for companies to raise money by marketing billings to a factoring firm at a discount. Factoring typically includes credit history control services, and also helps business launch cash from their borrower book. Here's whatever you require to understand about invoice factoring. Billing factoring is a kind of invoice finance, created for organizations that invoice their consumers and obtain repayment on terms.

Joe's Business requires aid with capital and concurs to a factoring center with a lender. The advance percentage in Joe's contract with The Billing Business is 80%, so when Joe raises an invoice worth 10,000 and also uploads it online, The Billing Firm advancements Joe 8,000. invoice factoring. As we have actually spoken about, one prospective benefit of factoring is credit rating control, so if the consumer was late paying what they owed Joe, The Billing Company would certainly contact them on his part as well as remind them the bill was past due.